mississippi income tax forms

Generally you must file a Declaration of Estimated Tax Form 80-106 for the income tax year if you do not have at least 80 percent 80 of your annual Mississippi income tax liability prepaid through withholding and if your annual tax liability exceeds 200. Income and Withholding Tax Schedule.

Individual Income Tax Forms Dor

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

. Who do I call about my Mississippi State Tax Refund. To sign a mississippi tax forms right from your iPhone or iPad just follow these brief guidelines. Get and Sign Mississippi Resident Individual Income Tax Return Form 8000 5 Single 6000 EXEMPTIONS Dependents in column B enter C for child P for parent or R for relative 6 A Name B 8 C Dependent SSN 9 7 Total number of dependents from line 6 and Form 80-491 Taxpayer Age 65 or Over Spouse Age 65 or Over Taxpayer Blind Spouse Blind Total dependents.

The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan. Tax rate of 5 on taxable income over 10000. Request for Copies of Tax Returns.

Mississippi Form 80-205 Nonresident and Part-Year Resident Return. You can learn more about how the Mississippi. You may download print and complete the following forms.

Expert Tax Pros at Jackson Hewitt Gets You Your Biggest Refund Guaranteed. 2021 Mississippi Income Withholding Tax. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income.

Upload the PDF you need to eSign. Tax rate of 4 on taxable income between 5001 and 10000. For married taxpayers living and working in the state of Mississippi.

0821 8 Amended 20 Net income tax due line 17 minus line 18 and line 19 6 A Name B C Dependent SSN MISSISSIPPI INCOME TAX 23 Total Mississippi income tax due line 20 plus line 21 and line 22 24 Mississippi income tax withheld complete Form 80-107. 19 rows Mississippi has a state income tax that ranges between 3 and 5 which is. If you underpaid or failed to pay your estimated income tax for the previous tax year you must file form 80-320 to calculate and pay any interest or penalties due.

E-File Free Directly to the IRS. Get Your Maximum Refund With TurboTax. Printable Income Tax Forms.

2021 Mississippi Individual Income Tax Instructions For Resident Non-Resident and Part-Year Resident. Individual Income all other returns. Individual Income Tax Instructions.

File Your Federal And State Taxes Online For Free. Do that by pulling it from your internal storage or the cloud. E-File Directly to the IRS State.

However if you owe Taxes and dont pay on time you might face late tax. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. UI-1 Status Report Business Registration form UI-23 R and Instructions-Reporting Quarterly Wages For reporting period beginning 2011.

Non-Resident and Part-Year Resident Return Nonresident. Make an appointment while you still can. Mississippi Income Tax Forms.

Ad If you havent filed yet do it today. Mississippi Form 80-108 Adjustments and Contributions. While most taxpayers have income taxes automatically withheld every pay period by their employer taxpayers who earn money that is not subject to withholding such as self employed income investment returns etc are often required to make estimated tax payments on a quarterly basis.

Tax rate of 0 on the first 1000 of taxable income. Payment Voucher and Estimated Tax Voucher Estimated. IndividualFiduciary Income Tax Voucher.

Mississippi has a state income tax that ranges between 3000 and 5000. Mississippi Form 80-180 Extension of Time to File. The personal exemptions allowed.

Mississippi Form 80-340 Reservation Indian Income Exclusion. Mississippi Income Taxes. Notably Mississippi has the highest maximum marginal tax bracket in the United States.

Mississippi 2021 Married - Spouse Died in Tax Year 12000 801052181000 Form 80-105-21-8-1-000 Rev. Unlike the Federal Income Tax Mississippis state income tax does not provide couples filing jointly with expanded income tax brackets. Mississippi State Income Tax Forms for Tax Year 2021 Jan.

Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Tax rate of 0 on the first 1000 of taxable income. Estimate payments may be filed on-line through TAP.

Mississippi Form 80-160 Other State Tax Credit. Create an account using your email or sign in via Google or Facebook. Ad Free 2021 Federal Tax Return.

Get Your Max Refund Today. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penalty.

Department of Revenue - State Tax Forms. Below are forms for prior Tax Years starting with 2020. The current tax year is 2021 with tax returns due in April 2022.

Install the signNow application on your iOS device. Tax rate of 3 on taxable income between 1001 and 5000. Single File this form with your employer.

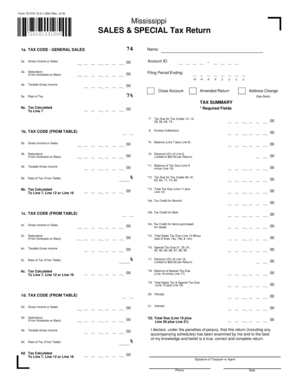

Form 80-320 - Estimated Tax Underpayment Form. Sales Tax Returns long forms. 2021 Mississippi Resident Individual Income Tax Return.

These back taxes forms can not longer be e-Filed. E-FIle Directly to Mississippi for only 1499. Renew Your Driver License.

The tax brackets are the same for all filing statuses. Locate Your Tax Refund. Details on how to only prepare and print a Mississippi 2021 Tax Return.

Box 22781 Jackson MS 39225-2781. Mississippi Form 80-105 Resident Return. A downloadable PDF list of all available Individual Income Tax Forms.

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. Mississippi Department of Employment Security Tax Department PO. Otherwise you must withhold Mississippi income tax from the full amount of your wages.

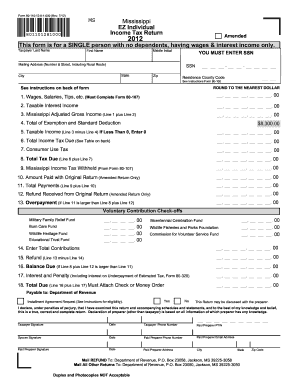

Tax rate of 3. Form 80-110 - EZ Individual Income Tax Form. Form 80-106 is a Mississippi Individual Income Tax form.

Purchase Hunting Fishing License. Individual Income refund returns. Failure to make correct.

819 MISSISSIPPI EMPLOYEES WITHHOLDING EXEMPTION CERTIFICATE Employees Name SSN Employees Residence Address Marital Status EMPLOYEE. Once you have completed a form you will need to mail it to.

State W 4 Form Detailed Withholding Forms By State Chart

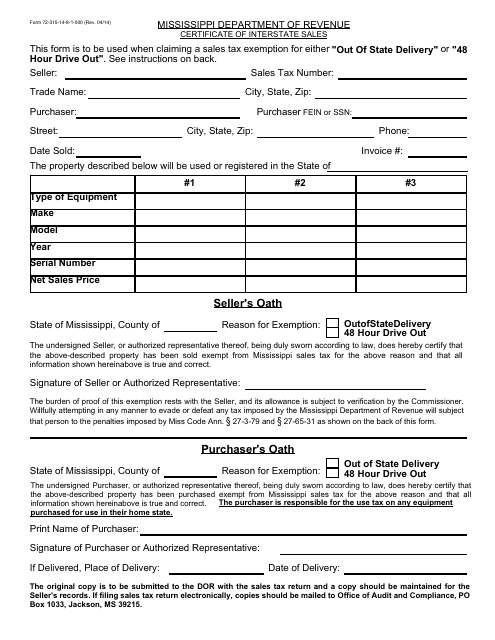

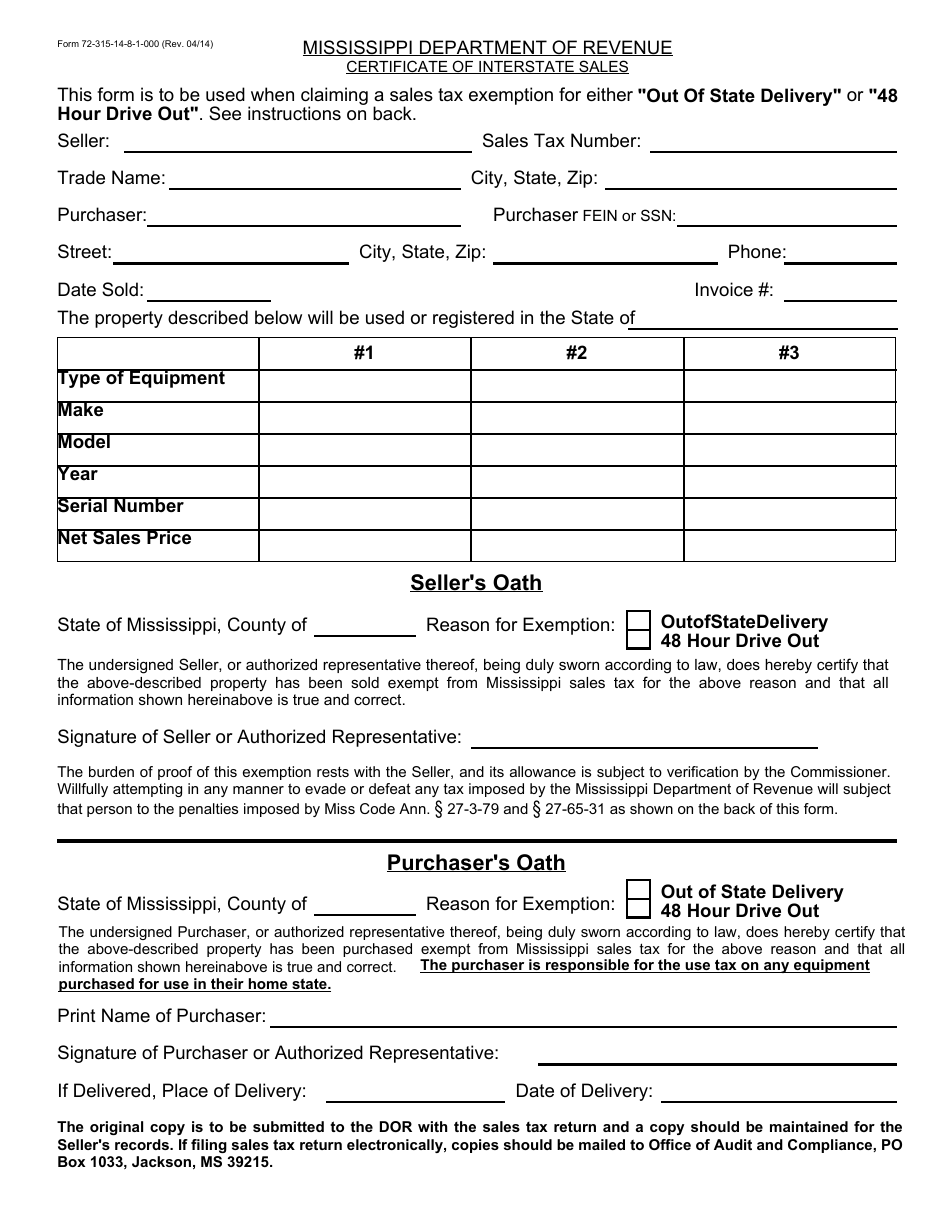

Form 72 315 14 8 1 000 Download Printable Pdf Or Fill Online Certificate Of Interstate Sales Mississippi Templateroller

Mississippi State Printable Tax Forms Fill Online Printable Fillable Blank Pdffiller

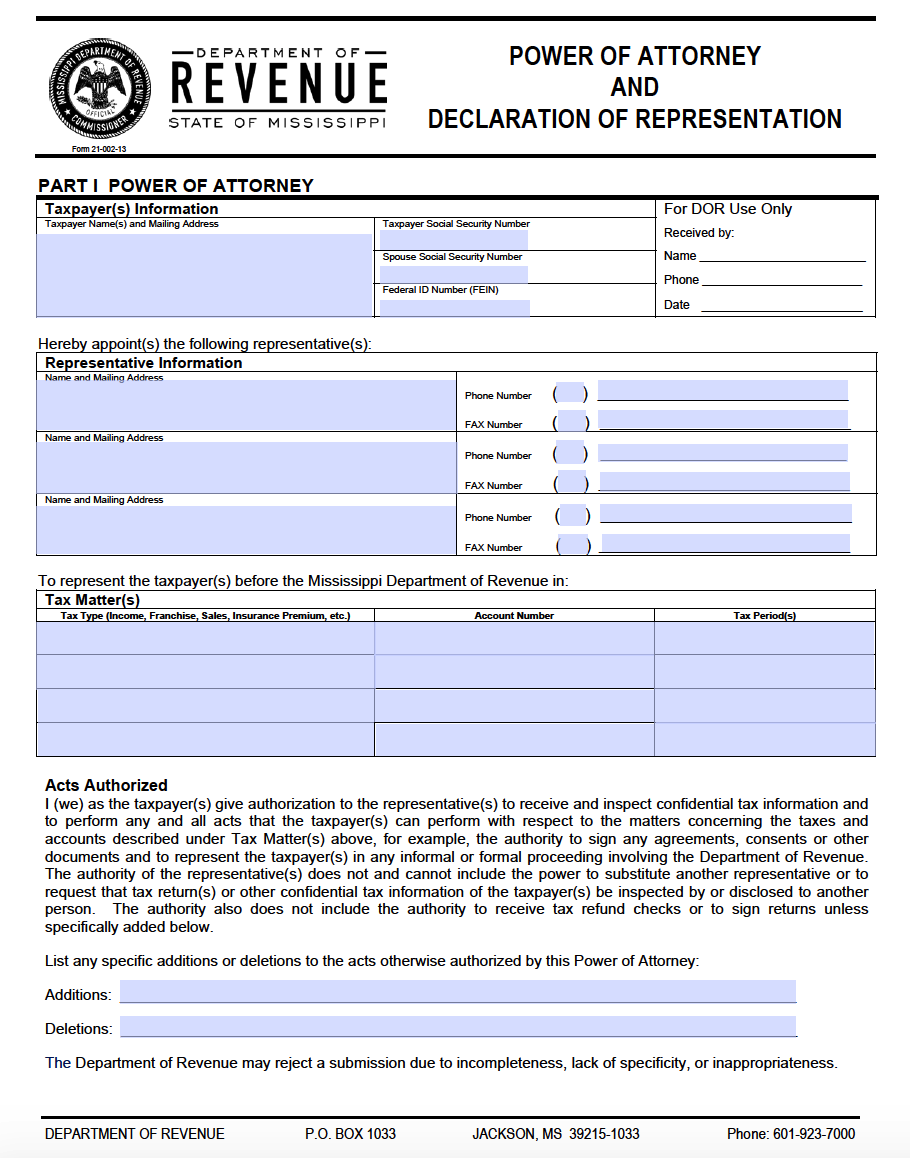

Free Mississippi Power Of Attorney Forms Pdf Templates

Mississippi State Printable Tax Forms Fill Online Printable Fillable Blank Pdffiller

2019 Schedule Example Student Financial Aid

Printable Mississippi Income Tax Forms For Tax Year 2021

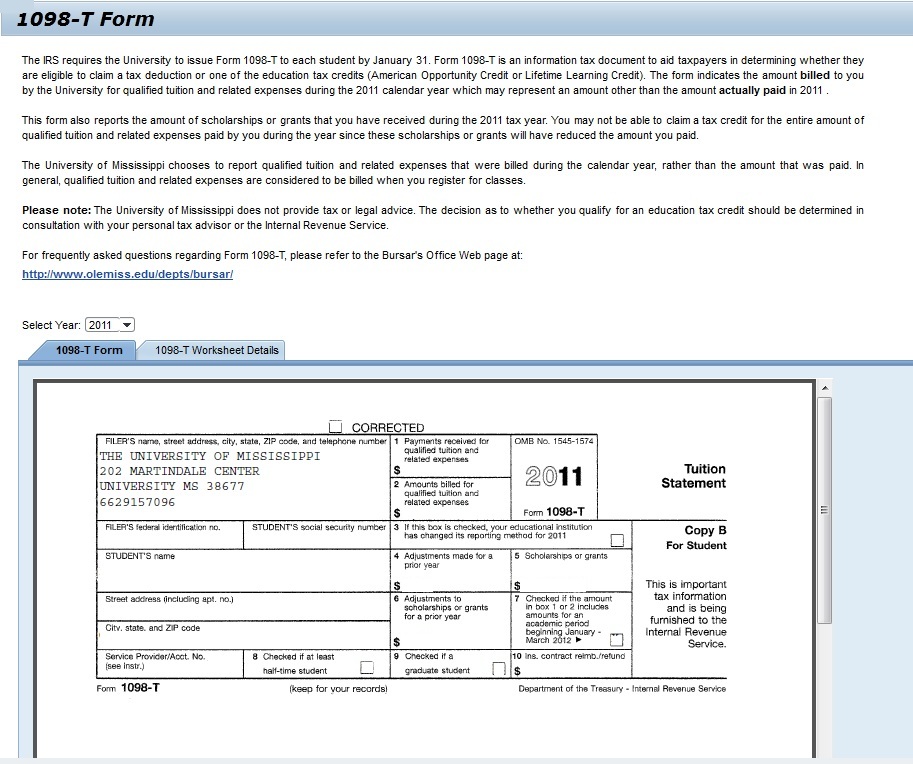

1098 T And 1042 S Tax Documents Technews Technews

Fill Free Fillable Forms For The State Of Mississippi

Fill Free Fillable Forms For The State Of Mississippi

Individual Income Tax Forms Dor

2020 2022 Form Ms Dor 72 010 Fill Online Printable Fillable Blank Pdffiller

2020 2022 Form Ms Dor 72 010 Fill Online Printable Fillable Blank Pdffiller

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Mississippi State Form W 4 Download

Form 72 315 14 8 1 000 Download Printable Pdf Or Fill Online Certificate Of Interstate Sales Mississippi Templateroller

2019 2022 Form Irs 8822 B Fill Online Printable Fillable Blank Pdffiller